Low-interest rate loans for Mobile Money and Bank Agents .

Yami is a fintech company with unique money lending solutions. We make access to funds easier at affordable interest rates for mobile money and bank agents.

Switching to Yami is easy

Our low-interest rate loans tailored for Mobile Money and Agency Banking, dedicated products for aggregators, and credit score system that rates performance have made us a reliable and cheap means of funding for mobile money and bank agents who are members of AMMBAN.

Loan Processed

We have helped over 3000 AMMBAN members with business booster loans.

Low Transaction Fee

Our interest rates are very low compared to the market rates.

AMMBAN Official Partners

Official Co-operative & financial partner for the Association of Mobile Money and Bank Agents in Nigeria.

Ready to take your business to the next level?

Fuel Your Business Growth with Yami Affordable Loans.

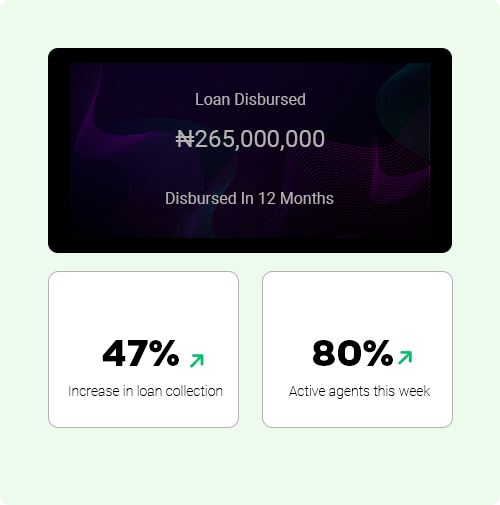

We are glad to be disbursing essential loans month after month, helping mobile money and bank agents access the funds they need to grow their businesses with flexible repayment terms and competitive interest rates.

tailored loan solutions for Mobile Money and Bank Agents

we understand the unique financial needs of Mobile Money and Bank Agents.

That’s why we offer affordable loan solutions tailored specifically for these businesses. Our loan facilities are designed to help you access the funds you need to grow your business without the high-interest rates typically associated with traditional lending institutions.

Frequently Asked Questions

Yami is a digital loan service company, tailored to offer bespoke loan support to mobile money and bank agents to enhance their financial Inclusion effort. Services offered include daily, weekly and monthly loan packages, financial advisory services and float support.

Yami is official financial partner for AMMBAN. Yami manages the cooperative arm of the association. So, if you are interested in benefiting from the services Yami offers, you have to be a registered and bonafide member AMMBAN and also enroll for the AMMBAN cooperative.

Yami offers a series of daily, weekly and monthly loans majorly to be used as floats for your agency banking business.

The interest rate is friendly, easy, and specially tailored to support agents. Interest rates are also fixed based on your performance, credit score and patronage overtime.

Within 24 hours after meeting all the necessary conditions.

Yes, we have a special loan package for business expansion. However, loan given to you for float MUST not be used for business expansion purposes.

Yami will expect that you payback your loan as at when due. Failure to payback affects your group members. Yami will thereafter take steps to recover the loan by our legal/recovery team.

Yes, part of the requirements for accessing Yami loan is that you MUST belong to a group, your performance is tied to that group.

Credit score is based on your performance in prompt repayment of your loan and that of your group members.

You must be a member of AMMBAN, you must be Operating agency business in Nigeria and you must have been in business for a minimum of 3 months.

You can contact Yami through the info below

yamiapp.ng@gmail.com